What Is Driving Increased Medallion & For-Hire Vehicle Values?

Once Uber and Lyft entered the New York City market and were able to grow unchecked, the yellow taxi market – which had persevered against the effects of the Depression, several recessions, and the 9-11 terrorist attacks – truly faced unprecedented challenges. With the Uber and Lyft fleets exceeding the size of the taxi fleet – and the app companies also subsidizing the trips and offering signing bonuses to drivers – the yellow taxis lost ridership and drivers, and the farebox suffered. At the same time, the robust lending abruptly stopped, and eight drivers committed suicide under the strain of the financial burdens they faced.

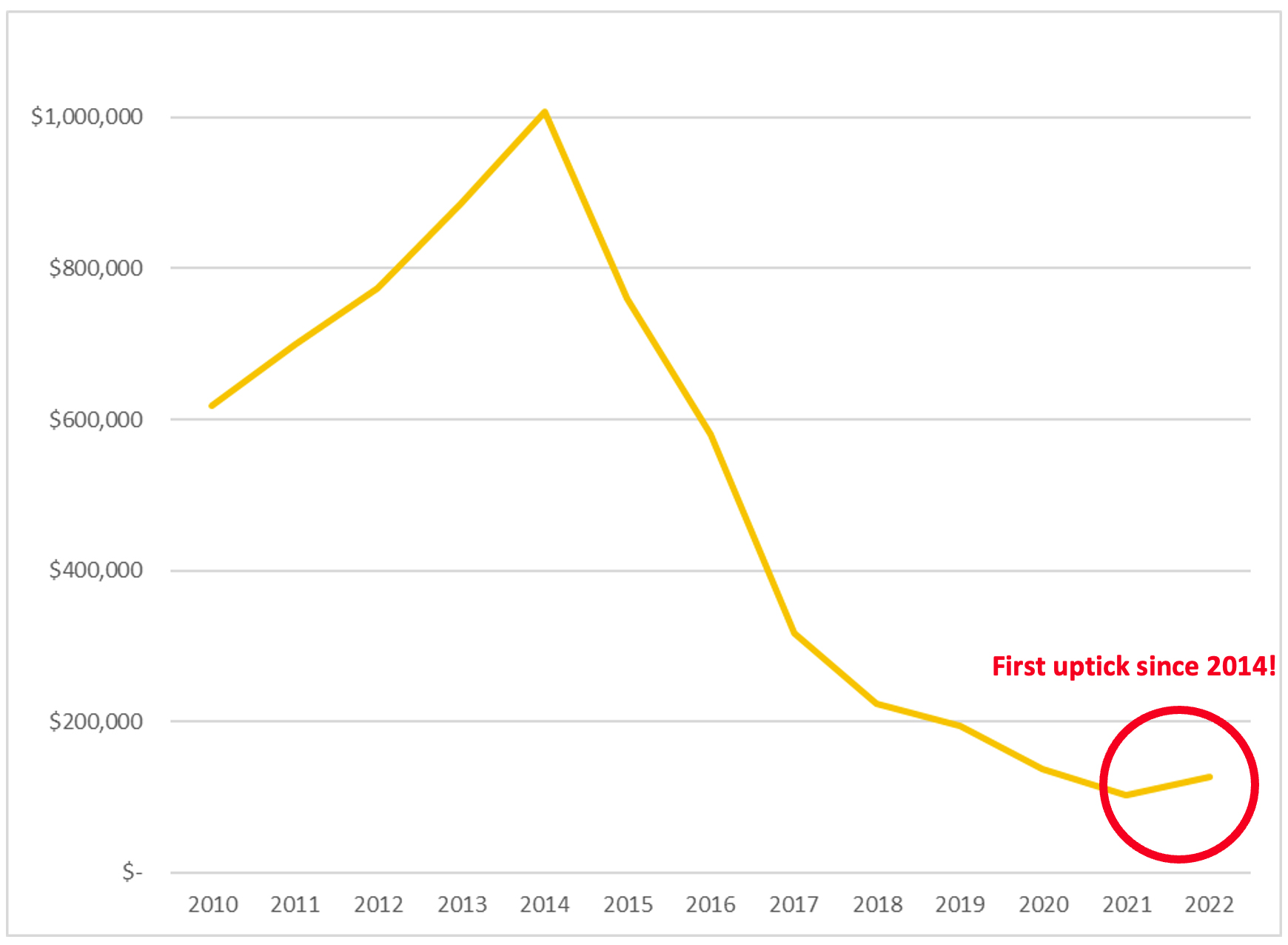

Then, the pandemic hit. With the shutdown of office commuting, Broadway shows, and business and personal travel, taxi ridership dropped by 96% at what could be defined as the nadir of the industry. Unsurprisingly, the value of taxi medallions followed suit, and plunged precipitously after 2014 to a low point in May 2021.

However, since last year, the values of taxi medallions have inched upward for the first time in eight years. Based on sales data from the New York City Taxi & Limousine Commission (TLC), the average medallion value has climbed from $79,106 in May 2021 to $137,330 in May 2022 – an increase of approximately 74%.

To put things into perspective, the average value is still 90% below the medallion’s $1.32 million peak in 2014. Still, due to a variety of City initiatives and other factors, there is a glimmer of hope that the medallion industry has finally navigated the app company onslaught, as demonstrated in Figure 1:

Figure 1. Taxi Medallion Values, 2010-2022

Numerous factors have contributed to this increase in sales prices over the past year, including the City’s creation of a Medallion Owner-Driver Relief Fund and the possibility of the first fare increase in ten years. If rising medallion prices are going to continue, what will make that happen?

Based on the recent uptick, one of the obvious considerations would be a corresponding uptick in the farebox and the amount taxicab drivers are earning per shift. The most recent data since Q2 of 2021 does not support such a conclusion. In fact, the observed uptrend in medallion prices over this period is not strongly correlated to ridership and farebox revenue. Over this period, the correlation coefficient between these factors and the price of medallions is merely 0.5, or 50%, as opposed to over 0.9, or 90%, in the pre-pandemic era.

Table 2. Daily Trips, Farebox Revenue and Medallion Prices, 2021-2022

As shown in Table 2, in July 2021, the average medallion sales price was $81,035.71, but the average number of trips was approximately 17.63 trips per day. In April 2022, reported medallion sales prices averaged $144,490.74, which represents a 77% increase in prices from July 2021. However, the TLC reports that taxicabs provided 18.6 trips per day in April 2022. This is good news, but represents only a 5.5% increase in trips per day in April 2022, when compared to ridership in July 2021. In other words, medallion sales price increases are outpacing increases in ridership.

In part, the significant differences may be based on the fact that ridership is reported in “real time” for each month, but the reported medallion sales prices were actually set months earlier when the deals were negotiated, especially during the pandemic when the TLC was only scheduling closings one day per week. In other words, the sales prices are “lagging indicators” for the medallion market. In light of the spikes in fuel prices in 2022 and the high inflation impacting operating costs since mid-2021, the impact of these external factors will need to be monitored. They could possibly offset the effects of the loan relief programs and other factors discussed below that have positively impacted the yellow taxi market.

Medallion Relief Program Provides a Boost to Medallion Owners!

In March 2021, former Mayor Bill de Blasio announced the creation of a $65 million Taxi Medallion Owner-Driver Relief Fund for financially troubled taxi medallion owners. The Medallion Owner Relief Program (MRP) was intended to provide debt relief to financially distressed medallion owners. Relief under the Program is limited to medallion owners who own at least one, but no more than five medallions.

Initially, the MRP was structured to provide owners with a $20,000 grant per medallion, which could be used to negotiate and restructure loans with lenders. This $20,000 grant would serve as a down payment to entice lenders to restructure distressed medallion loans. Under the MRP, a lender can restructure loans by reducing the principal, lowering interest rates, extending the amortization schedule and balloon date, and/or accepting a discounted payoff.

When the TLC held a public hearing to discuss the proposed rules for the MRP, the proposed terms were met with nearly unanimous opposition by medallion owners and industry stakeholders. Advocates for the medallion industry all agreed that a $20,000 grant per medallion would not guarantee medallion owners a livable wage or incentivize lenders enough to restructure loan payments to a manageable level. Further, those opposed to the proposed MRP terms called for TLC to guarantee the medallion loans for those who participated in the MRP. Even with this criticism, on October 6, 2021, the TLC enacted the proposed rules and the MRP began.

After the MRP was approved, medallion owners, advocates, and supporters continued to hold demonstrations, and some even went on a hunger strike as a means to have their voices heard by City government. The hunger strike lasted 15 days and called for the City to modify the MRP rules and provide a guarantee for medallion owners. On November 3, 2021, after months of demonstrations, the U.S. Senate Majority Leader, Charles Schumer, announced an agreement with the City, known as MRP+, which included the largest medallion lender, Marblegate Asset Management. MRP+ supplements the MRP and includes a City-funded deficiency guarantee, which means a greater principal reduction and lower monthly payments for eligible medallion owners.

Under MRP+, Marblegate agreed to restructure outstanding loans to a principal balance of $200,000. This balance constitutes a $170,000 guaranteed loan, and medallion owners also receive an increased City grant of $30,000. The terms of the new Marblegate loan include a 5% interest rate and a 20-year, fully amortizing term. Under these new terms, monthly payments are capped at $1,122 per month for eligible medallion owners.

The City promised to provide funding for the guarantee with Marblegate. The City then invited other lenders to participate in MRP+ under the same terms as Marblegate. With the election of Mayor Eric Adams and his appointment of TLC Commissioner and Chair David Do, the support for these programs continues. In fact, TLC Chair Do said during his confirmation hearing on May 17, 2022, that helping more drivers access the available debt relief programs is one of his top priorities.

In May 2021, before the MRP was implemented, medallions sold for an average of $79,105. However, since the MRP announcement, there has been an uptick in medallion sales. One year later, in May 2022, 65 medallions sold for prices between $100,000 and $185,000. Of note, less than half of those sales were foreclosures.

While there are many factors impacting the demand for medallions, the MRP and MRP+ have certainly increased buyer confidence in the medallion market.

Fares Finally Fair? Taxicab Rate of Fare Increase May Be Imminent!

As I have previously noted, several factors in the industry have created a “perfect storm, in a positive way” for the steady rise in medallion prices. While it is still unclear to what extent the medallion industry bounces back, the increase in medallion sale prices is a positive sign for the industry’s future. The TLC, under the leadership of Chair Do, has committed to prioritize the medallion industry’s recovery and is currently undergoing a wholesale review of the taxicab rate of fare.

The TLC has not increased taxicab fares in a decade. The current metered rate is $2.50 plus 50 cents for every one-fifth mile, along with surcharges depending on when and where a cab is traveling. Some advocates have proposed an increase of between $1.50 and $2.00 to ensure drivers can earn $25 per hour after expenses.

During his confirmation hearing, David Do hinted that he would support some amount of increase. The TLC has yet to provide a specific proposal for the fare increases, and the agency will be reviewing the public comments and medallion owner financial data throughout the summer of 2022 to develop a plan. In recent months, the promise of higher fares may have helped nudge medallion prices up.

The Medallion Task Force Set the Stage to Stabilize the Medallion Market

At the end of 2018, in response to the rapid decline in taxicab medallion prices and indebted medallion owners, the City of New York created a task force to study the sale prices of medallions. The task force was charged with reviewing sale prices of taxicab medallions and their impact on the City’s budget and then recommending changes to laws, regulations, and policies related to medallions.

The Taxi Medallion Task Force, co-chaired by then-Council Members Ydanis Rodriguez and Stephen Levin, ultimately had 19 members, including fleet owners, driver advocates, academics, and representatives from financial institutions. The 77-page report issued on January 31, 2020, charted the history of the rise and fall of the medallion values, which the Task Force attributes to “multiple factors,” including increased competition from services like Uber and Lyft that diminished taxi earnings. The report also made several recommendations focused around addressing the financial crisis of “over-indebted” medallion owners and modernizing taxi service to adapt to a marketplace dominated by apps.

The report can be accessed at http://council.nyc.gov/data/wp-content/uploads/sites/73/2020/01/Taxi-Medallion-Task-Force-Report-Final.pdf.

Prior to the issuance of the report, the TLC had already moved forward with sweeping new regulations with respect to taxi brokers and agents, which impact drivers, owners, lenders, and other stakeholders. The Task Force also recommended that the TLC adopt the rules that the agency proposed in October 2019 to amend the agency’s medallion broker and taxi agent rules. The TLC voted to adopt those rules on February 5, 2020. Given the City’s involvement in the medallion market, the Task Force stated that the City “should take action to address the medallion debt crisis and help medallion owners who are currently struggling with unsustainable debt.” That sentiment was the guiding principle for the MRP and MRP+ initiatives subsequently implemented.

New Pandemic Programs Helped Keep the Taxi Industry Alive

It is important to also recognize the steps taken by the TLC during the pandemic to assist the taxicab industry – and the for-hire vehicle (FHV) market as well – to recover from the devastating effects of the pandemic-driven economic shutdown that began on March 16, 2020, and resulted in a 96% decrease in ridership, literally, overnight. For example, to provide assistance to homebound New Yorkers during the pandemic, the City coordinated food delivery by taxi and FHV drivers. TLC-Licensed Drivers delivered more than 65 million meals citywide, and earned $40 million in wages for their participation in the emergency GetFoodNYC program, which included food delivery services that ran from March to October 2020.

Additionally, when the MTA shut down 24-hour subway service from 1:00am to 5:00am to allow for the cleaning of subway cars, the City utilized taxis, Street Hail Livery Vehicles (green cabs), and FHVs from May 2020 to August 2020 to provide free transportation services for emergency workers while the subway was shutdown overnight. The MTA and City of New York should look into making these programs permanent to help the industry, and possibly even enter into contracts with the taxi and for-hire industry for municipal employee transport in order to reduce the number of city owned vehicles on the road.

It is my hope these great programs started during the program will resurface – but if not – they definitely helped the industry get to the other side of the pandemic by minimizing the economic pain.

The Groundbreaking Uber-Taxi Partnership

In addition to the debt relief programs and the potential fare increase, the new partnership announced on March 24, 2022, between Uber and the taxi technology companies Curb and Creative Mobile Technologies (CMT) may be contributing to increased optimism that could impact how buyers and sellers view the future value of medallions. Uber’s partnership was announced to begin in New York City, and will expand nationwide during 2022.

The integration enables Uber, as well as Curb and CMT, to offer riders and drivers more flexibility and coverage as urban transportation ramps back up in the post-pandemic recovery. Taxi drivers will have access to trip offers from Uber on top of the millions of annual ride requests already made through the taxi apps, while Uber users will have more ride options to meet their needs as they travel. This partnership will allow customers to order a taxicab directly on the Uber app.

While Uber has been seen as a rival for most in the medallion industry, this partnership may help taxicabs get back on the radar with customers by providing the same upfront pricing, through the same application that customers are accustomed to using. This may increase the number of rides for taxicab drivers and provide access to a larger pool of customers who currently use the Uber app. While the TLC believes this program will benefit the industry, critics and advocates for medallion owners believe that the earnings will not be enough to benefit taxicab drivers, and they will continue to push for a fare increase and better payment terms with Uber. Incoming TLC Chair David Do indicated his support for initiatives that can provide additional revenue opportunities for taxi drivers, and implementing the Uber partnership with the taxi apps will likely be one of his top priorities in the coming months.

Impact of Medallions in Storage at TLC

Another factor to consider is the “inaction” by the TLC. Under the TLC rules, taxi medallions may be placed in storage. However, the TLC rules expect that taxis will be out on the street. Under the New York City Administrative Code, the TLC is allowed to revoke any medallion that is in storage for more than 60 days. During the medallion crisis of the past decade, the TLC allowed medallions to remain inactive and in storage indefinitely. Indeed, during the pandemic, more than half of all medallions were in storage. Had owners been forced to operate these medallions – and also been forced to pay for insurance and other operational costs – the effects would have been devastating. With the TLC continuing to exercise discretion in enforcing its storage rules, medallion owners may return to the market as post-pandemic conditions improve, and the supply may increase to meet ridership demands.

A New Hope for the Future – Electric Taxis & Charging Infrastructure Funding

Innovations and positive developments with electric vehicles could possibly usher in a new era for the struggling taxi industry, as well as for the for-hire vehicle industry. In May 2021, the TLC approved a battery electric vehicle (BEV) Taxi Pilot Program – the pilot would operate for 12 months from the first BEV enrolled. This pilot increases the number of EV options available to use as taxis beyond the already-approved Tesla Model 3.

Pursuant to the pilot terms, medallion vehicle specifications regarding horsepower and acceleration have been modified for several BEVs that meet TLC’s interior volume standards. While the pilot is set to run for 12 months after the first battery electric taxi is certified for use, new BEVS will remain licensed as long they comply with TLC rules. There are nine approved BEVs in the pilot, including, among others, the Tesla Model Y, the Ford Mach-E, and the Kia Niro.

The Biden administration’s targeted goal of 50% EV sale shares and network of 500,000 chargers by 2030, along with stricter vehicle efficiency rules of 49 miles per gallon by 2026, will hopefully help spur the electrification of taxis.

In April 2022, Governor Kathy Hochul announced that the state’s EVolve NY electric vehicle charging network will soon have more than 100 high-speed charging ports across the state. The increased number of charging stations will help foster the expansion of BEV taxis, to help make the yellow taxi fleet “green” with indirect, or possibly direct, support through the programs and grants being developed.

Out of the FHV Cap, A New Market Emerges – Sales of FHV Corporate Stock

In August 2018, in response to the unchecked growth of Uber and Lyft, New York City enacted Local Law 147, imposing a one-year cap on the issuance of new FHV licenses with limited exceptions for wheelchair accessible vehicles (WAVs) and certain lease-to-own situations. Local Law 147 also delegated to the TLC the authority to decide the number of FHV licenses the agency would issue after one year passed and any exemptions the agency deemed appropriate. Since August 2019, the TLC has reviewed the FHV licensing cap every six months.

The TLC added an exemption to the FHV licensing cap for battery electric vehicles (BEVs) in August 2019. However, on June 22, 2021, the TLC suddenly changed its policy and formally removed the BEV exemption to the FHV licensing cap, based on the agency’s concern that the number of FHV license applications under the exemption would increase and add to congestion. Existing FHV license holders still have the opportunity to convert their existing vehicles to EVs.

Under the NYC Administrative Code and the TLC rules, FHV licenses or FHV “diamonds” cannot be sold or transferred. However, if a license is held by a corporate entity or business, then that business entity that owns the FHV licenses (and, perhaps the vehicles as well) may change ownership, and the new owner would retain and operate the FHV license or licenses as the assets of that entity.

When the City implemented the FHV licensing cap, it effectively created a “mini medallion” market for corporate FHV licenses. Prior to the FHV licensing cap, there was no demand for an FHV license, as anyone who wanted one would simply apply for a license and pay the licensing fee. However, with the FHV licensing cap in place, individuals do not have the option of applying for an FHV license, and the number of FHV licenses available for purchase are further limited to those owned by business entities.

There are some notes of caution for this new FHV license market. First, the cap on the FHV licenses may be modified, or even lifted, by the TLC in its semi-annual reviews of the FHV license cap. For example, the BEV exemption may be restored or re-introduced to allow for a number of new FHV licenses limited to BEVs. The City Council followed up on its Medallion Task Force with a Black Car and Livery Task Force to review the steps that could assist the traditional black car and livery bases. Among the recommendations in its December 2021 report was the consideration of issuing restricted FHV licenses for the traditional black car, luxury limousine, and livery bases that also lost business as the app companies grew unchecked.

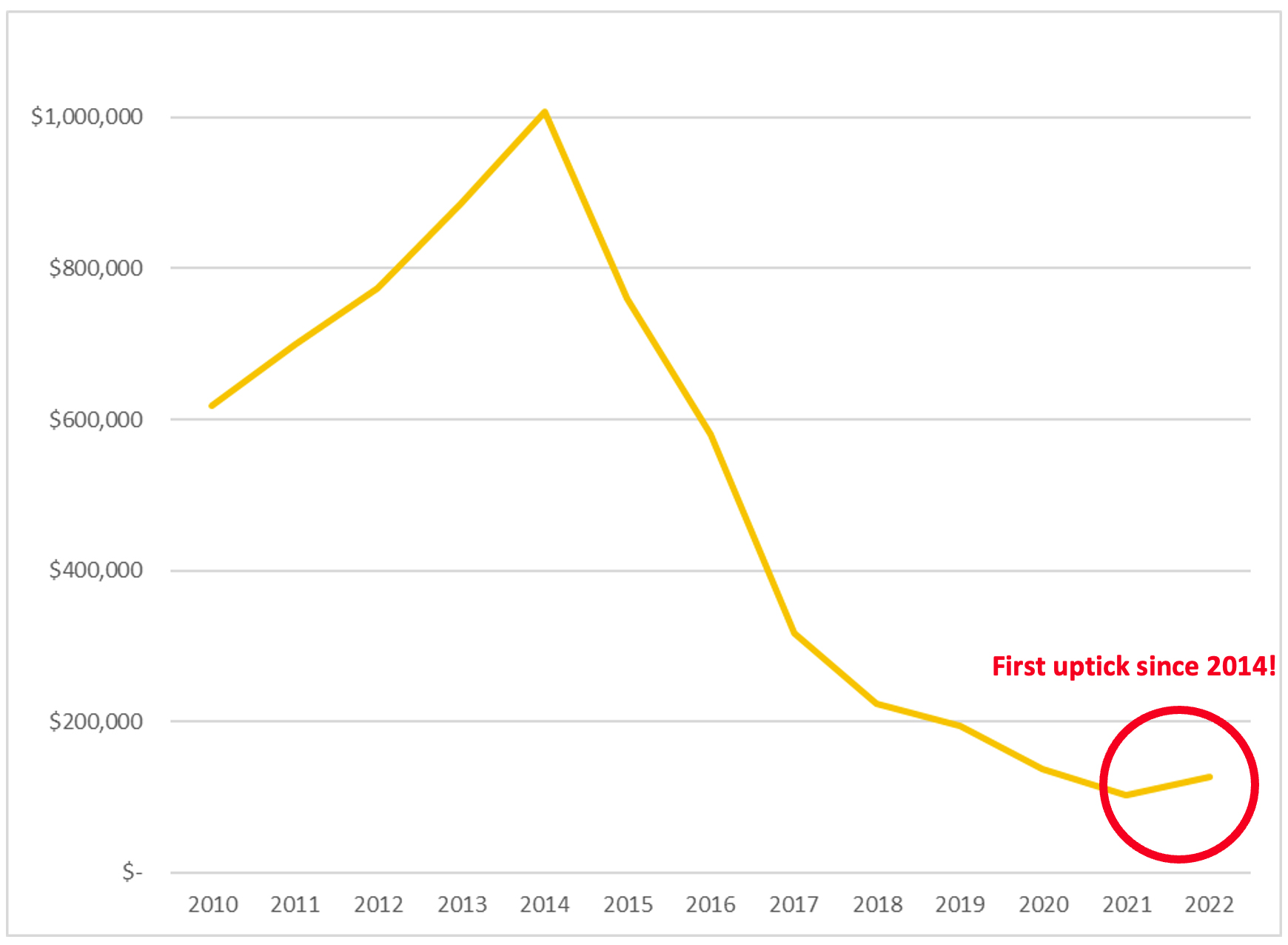

Even with these concerns, including the additional caution that the FHV licenses do not have a property interest in the same manner as a taxi medallion, which would constitute a “taking” that would provide the medallion owner with compensation for the loss of the medallion, the new market for FHV licenses continues to grow, and prices have especially surged since the TLC removed the BEV exemption in 2021. In June 2021, the asking price for one FHV license was around $9,000. Six months later, it ballooned to $20,000. Today, the asking price is hovering around $28,000 – for just the FHV license.

Figure 2. FHV Permit Values, June 2021-May 2022

| Timeframe | FHV Permit Value |

| June 2021 | $9,179.10 |

| July 2021 | $9,788.94 |

| August 2021 | $11,890.97 |

| September 2021 | $13,678.07 |

| November 2021 | $15,111.11 |

| December 2021 | $20,218.38 |

| January 2022 | $24,625.08 |

| February 2022 | $29,375.08 |

| March 2022 | $30,317.20 |

| April 2022 | $28,068.63 |

| May 2022 | $28,133.88 |

Calculations are based on monthly transactions/offerings published at TLC Rental Marketplace. Some of these offerings included both plates and vehicles, and in these instances, the prices were adjusted to exclude the value of the vehicles. The value of the vehicles were determined using Kelley Blue Book’s trade-in value tool, which included variables such as year, make, model and mileage.

While the market is growing, it presents particular challenges for buyers and sellers alike. Since the FHVs may not be transferred directly, the buyer needs to understand the deal will require a stock purchase or membership interest acquisition. As a result, the buyer will need to perform due diligence on the company’s liabilities. Claims from vehicle crashes may not be filed until well after the transfer. Also, taxes or other liens may only be known after the closing. My legal team at Windels Marx has handled many sales of transportation businesses, as well as providing due diligence advice to buyers and sellers involving FHV permits over the years. In the representative matters for such sales, we have seen a variety of these “hidden liabilities” only appear after the closing. As a result, we have crafted agreements to address these unknown liabilities, some of which may not be known until months after the closing.

Whatever Happened to Black Car Radio Rights & Green Borough Livery Cabs?

The discussion of the taxi medallion market today needs to also include some mention of how the threat of the Street Hail Liveries (SHLs) – the green borough livery cabs – did not materialize.

New York State enacted the current Street Hail Livery Law in February 2012. The Street Hail Livery Law sought to address two key issues: the lack of accessible vehicles for City residents and non-residents with disabilities, and the lack of availability of yellow cabs in the four boroughs outside Manhattan as well as the areas of Manhattan outside of its central business district. The final version allowed for New York City to issue 18,000 permits for SHL vehicles that are allowed to accept street hails in the City except in Manhattan’s Central Business District and at the airports. The 18,000 SHL vehicle permits were to be issued in three consecutive, annual sales, with a minimum of 20% of licenses issued to wheelchair accessible vehicles. To encourage the creation of accessible SHL vehicles, the law also created a $15,000 subsidy from the City and a $10,000 State tax credit to offset the additional costs to modify a vehicle.

The initial 6,000 SHL permits were quickly obtained by eligible owners. The fee to purchase a SHL Permit between June 12, 2013, and June 11, 2014, was $1,500. The 1,200 Wheelchair Accessible SHL permits issued with the first group were offered for free. After the first traunch of 6,000 permits, there was a waiting list for the second offering of 6,000 SHL permits. In June 2014, the TLC offered a second traunch of SHL permits for $3,000 each for either a Wheelchair Accessible or non-Wheelchair Accessible permit. Unlike the success of the first offering in 2013, the second offering did not sell out.

At the same time, the app companies were growing unchecked until the FHV license cap was enacted in August 2018. During this period, the app companies – which flooded the NYC market with their fleets and subsidized trips – won the market share in the outer boroughs and northern Manhattan for trips that were supposed to be made by the green cabs. As a result, the City never released the third traunch of SHL permits, and there are only 1,027 green cabs on the street today.

The SHL permits were transferred by owners in those first two years after the program was started. That market is no longer viable. In other words, the app companies impacted yellow taxi ridership and also effectively took over the anticipated market for the green cabs.

The app companies likewise adversely impacted the franchise market for the black car industry. Under the TLC rules, all black car vehicles are owned by franchisees of the black car base or are members of a cooperative that operates the base. Black car drivers would buy the radio rights to operate and accept dispatches with a base. The drivers’ interests could be sold to another owner with the base or to entrepreneurial drivers.

Although this information is proprietary, through my work in the industry, these radio rights would once sell for $50,000 or more – especially since these owners could lease out their rights to other drivers who did not have the capital to “buy in” or own an FHV, but simply wanted to earn income as FHV drivers. However, as Uber and Lyft grew unchecked and offered signing bonuses and the idea of more trips to FHV drivers, the value of these radio rights dropped as well. Indeed, the challenges the app companies brought to the traditional black car bases were the reasoning in support of creating the Black Car and Livery Base Task Force.

The Road Ahead for Medallions & FHV Corporate Sales/Values?

Today, the taxi industry in New York City is certainly facing new challenges, which include higher fuel costs, high inflation, and driver shortages. Even so, the trends in favor of the taxi industry are just as obvious.

First, we are observing a modal shift from subways to vehicles due, in part, to the well-known increases in crime in the subways. Second, there will continue to be a return to “normal” as the City emerges from the pandemic and travel, tourism, Broadway, and office commuting continue to increase. Third, the MRP+ allows for medallion loans to be guaranteed up to $170,000 – an amount that has still not been reached in the current sales. Fourth, all indications are that the FHV license cap will continue in some manner. Fifth, the TLC may approve a rate increase before the end of summer 2022, which could lead to long-term increases in the farebox. Sixth, the effect of the Uber deal with the taxi apps and the expected increases in trips per shift is still unknown, yet the potential positive implications for taxi drivers has created optimism among some in the industry. Seventh, the possibility of restoring the pandemic programs with government subsidies and funding opportunities for EVs and charging infrastructure are positive signs. Last, but certainly not least, there is renewed optimism in all industries due to new innovative leadership at City Hall and at the TLC.

So many factors have pumped new life into the once-declining taxi industry. For the first time in eight years, there are real signs of recovery in the medallion market. These signs were in place even before the industry sees the full effects of the medallion relief program, the fare increase, and the Uber deal with the taxi apps.

In terms of the political landscape, most every local elected official is a champion of supporting taxi drivers in NYC, which means that support for driver income, benefits, and well-being will drive almost every administrative, legislative, and policy decision. It is highly unlikely that the status quo will be altered anytime soon in terms of the FHV cap and other pro-taxi policies. While the road to recovery may be long, it seems that the uptick in medallion sales prices may continue in the near future and, hopefully, the worst days for the yellow taxi market (and for all for hire industries) are viewed in the rearview mirror.